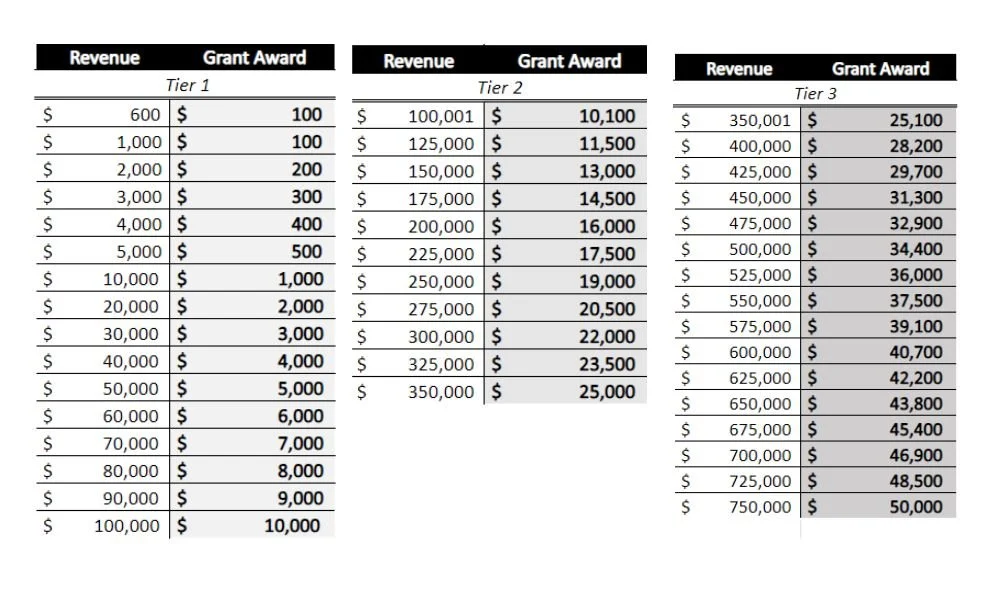

Award Calculation

Overview: This document is to help potential applicants better understand how much their business could receive from the MN PROMISE Act grant program fund.

IMPORTANT: The chart below can help provide an estimate of the award the business could receive. These projected award amounts are based on the gross annual revenue reflected on business tax returns from the most recent completed tax year. These tax returns will be reviewed and verified.

Grants are reviewed and awarded based on eligibility, preference level, and randomization. NO ELIGIBLE APPLICANT IS GUARANTEED TO RECEIVE A GRANT.

*Changes will occur according to the State of Minnesota as the PROMISE Act program progresses.